A Traditional IRA serves as a valuable tool for individuals seeking to save for retirement while deferring taxes. Nevertheless, several factors come into play when assessing eligibility for contributions and the potential tax deductibility of those contributions.

Earned Income Eligibility

To contribute to a Traditional IRA, you must have earned income. Earned income includes wages, salaries, tips, bonuses, and self-employment income. Passive income such as investment earnings or rental income does not qualify as earned income for IRA contribution purposes.

What makes a Traditional IRA contribution deductible?

A Traditional IRA contribution may be deductible if you are not covered by an employer-sponsored retirement plan or if you are covered by a retirement plan but meet certain modified adjusted gross income (MAGI) thresholds determined by the IRS. In addition, any contribution to a Roth IRA may impact that amount you are eligible to deduct.

Influence of Roth IRA Contributions

Contributions to a Roth IRA can impact the deductibility of Traditional IRA contributions as they are both subject to IRS annual contribution limits that apply across all IRA accounts, regardless of type. While contributing to a Roth IRA does not prevent you from contributing to a Traditional IRA, it may impact the amount you can deduct from your taxes.

Employer-Sponsored Plan Coverage

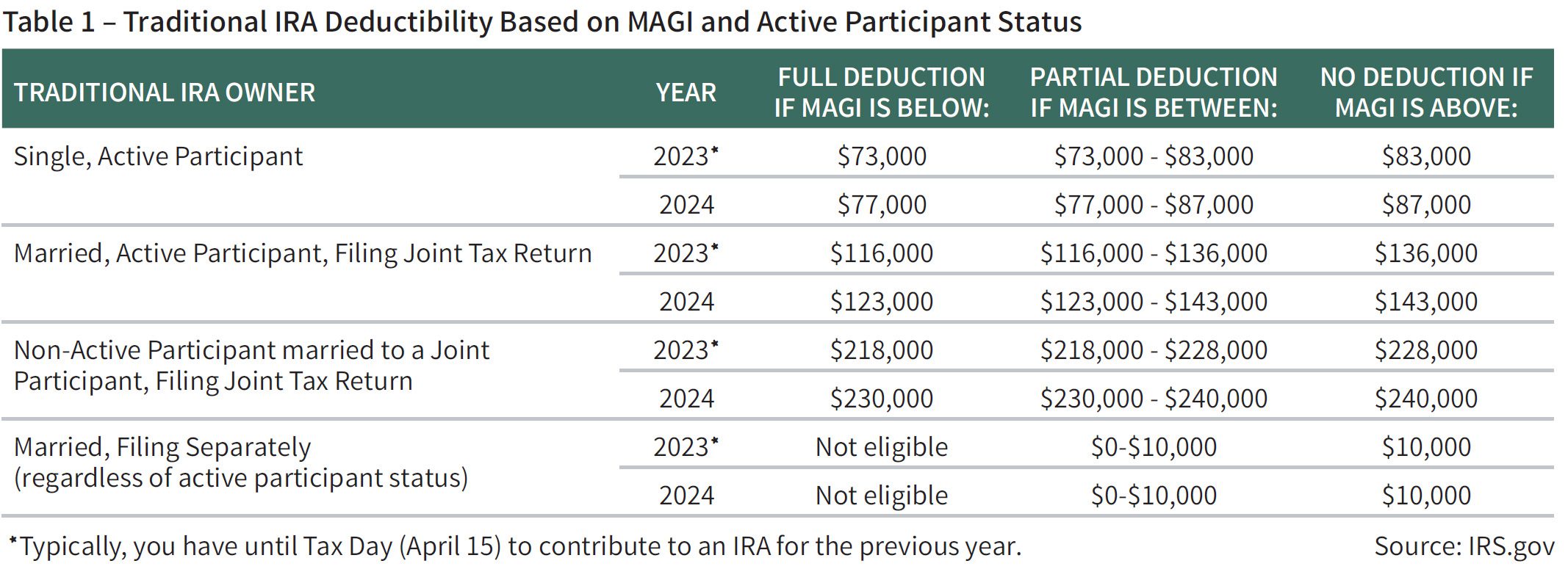

Another factor affecting Traditional IRA deductibility is coverage under an employer-sponsored retirement plan, such as a 401(k) or 403(b). Active participation in such a plan, which generally means making contributions during the given tax year, may impact Traditional IRA deductibility. However, even if you or your spouse are active plan participants, you may still qualify for full or partial deduction based on your MAGI. The thresholds for deductions are as follows in Table 1.

Conclusion

Navigating the landscape of IRA deductibility requires a thorough understanding of these factors. Consulting with your financial planner can provide personalized guidance tailored to your situation, ensuring you make the most tax-efficient decisions for your retirement savings.

Written: February 21, 2024